|

|

|

Arabi Gin

Cotton 'Links'

Market Data

News

Weather

Market Alerts

Resources

|

Is West Pharmaceutical Services Stock Underperforming the Dow?/West%20Pharmaceutical%20Services%2C%20Inc_%20phone%20and%20site-by%20T_Schneider%20via%20Shutterstock.jpg)

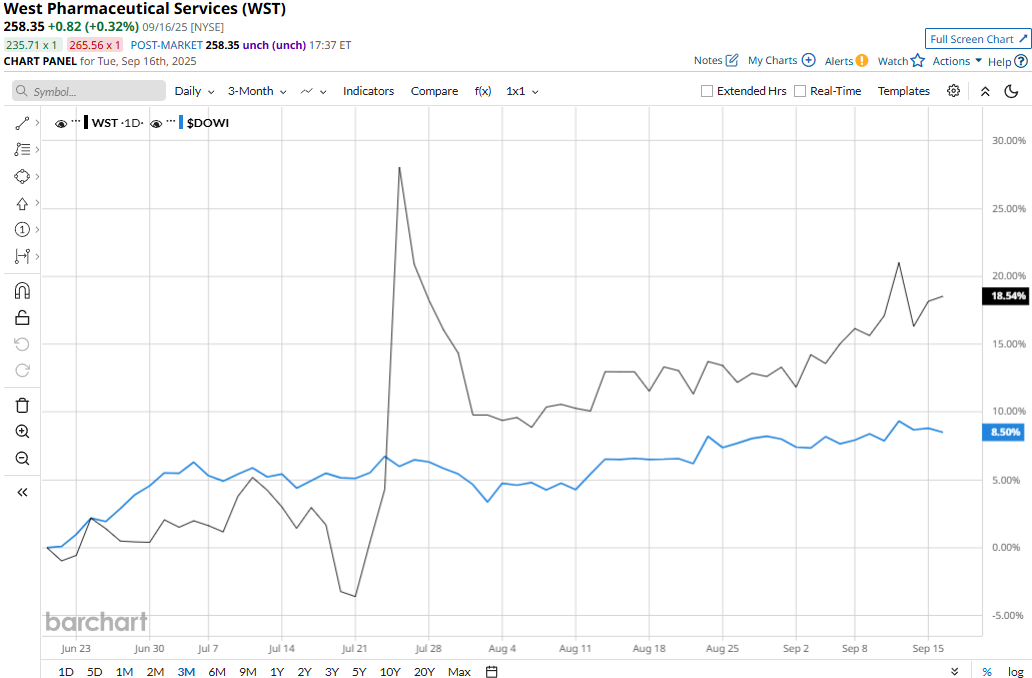

Exton, Pennsylvania-based West Pharmaceutical Services, Inc. (WST) designs, manufactures, and sells containment and delivery systems for injectable drugs and healthcare products. With a market cap of $18.5 billion, West Pharmaceutical’s operations span the Americas, Europe, the Middle East, Africa, and the Indo-Pacific. Companies worth $10 billion or more are generally described as "large-cap stocks." West Pharmaceutical fits right into that category, with its market cap exceeding this threshold, reflecting its substantial size, influence, and dominance in the medical instruments & supplies industry. Despite its notable strengths, WST stock has plunged 26.7% from its 52-week high of $352.33 touched on Oct. 24, 2024. However, WST stock has soared 15.2% over the past three months, notably outperforming the Dow Jones Industrial Average’s ($DOWI) 7.6% gains during the same time frame.

Over the longer term, West Pharmaceutical’s performance has remained grim. WST stock is down 21.1% on a YTD basis and 13% over the past 52 weeks, underperforming the Dow’s 7.6% uptick in 2025 and 9.9% surge over the past year. The stock has traded mostly below its 200-day moving average since February, with some fluctuations, but has remained above its 50-day moving average since June, underscoring its longer-term bearish trend and recent upturn.

West Pharmaceutical’s stock prices shot up 22.8% in a single trading session following the release of its robust Q2 results on Jul. 24. The quarter was marked with strong GLP-1 elastomer growth, solid momentum in HVP conversion, and continued normalization of customer ordering patterns. The company’s net sales for the quarter increased 9.2% year-over-year to $766.5 million, exceeding the consensus estimates by a notable 5.4%. Further, its non-GAAP EPS of $1.84 surpassed the Street’s expectations by 21.9%. Moreover, the company raised its full-year revenue guidance from the previous $2.945 billion - $2.975 billion to $3.04 billion - $3.06 billion, along with a notable increase in EPS guidance, boosting investor confidence. However, when compared to its peer, WST has underperformed ResMed Inc.’s (RMD) 19.2% surge on a YTD basis and 8.3% gains over the past year. Nevertheless, the stock has a consensus “Strong Buy” rating among the 15 analysts covering it. Its mean price target of $319.25 represents a 23.6% premium to current price levels. On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|